EQUITYBASE - Decentralized Real Estate Exchange power by blockchain

About Equitybase ICO

Equitybase is a end-to-end commercial real estate property ecosystem for project evaluation, credit risk, liquidity, fully on the blockchain. Equitybase allows developers and fund managers to offer asset-backed investment opportunities to investors around the world.

Used in investment or trading when buying base capital tokens at an equivalent cost, without bearing fees on our platform. Participants around the world will be able to use our platform for investment and diversification of their portfolio, along with liquidity in the market, but generate private market revenues. With the support of our specialists with extensive experience and reputation in the field of real estate, consumer electronics and the high-tech industry, we at Equitybase raised $ 300,000 of round seeds. We created and issued a high profile on the companies website, with extensive experience in real estate and operating start-ups over the past 15 years.

By the summer of 2018, the full functionality will be launched on our Equitybase platform. Where any participants will be able to invest in shared commercial real estate and receive dividends from the lease, we roll with the satisfaction of the asset that will be passed perfectly on the contract and paid off the crypto or fiat currency along with the liquidity of the traditional public markets. By the fall of 2018, iOS and Android will be available to our platform users also, with the full functionality of our site reliably on their mobile devices.

In a simpler language - a real estate exchange based on blockchain

What are the current investment model problems?

- Liquidity to Private Markets (Equity investment has a lengthy lock-up period of 3-10 years)

- Accessibility of Financing (Developers will only be able to obtain funding from within the country)

- The cost of the loan (the interest rate depends on the region and the own funds of the developers will be significant)

- Barrier entry (Commercial investment requires a huge amount of start-ups)

- Low Level of Return (the stock market for the last 10 years averaged 7% of profit per year)

- High Management Fee (Private capital management fees range from 2-4% per year)

- World Access (Developers from around the world will be able to post their projects on our Equity Invest platform and raise sufficient capital with ease)

- No Minimal Investment (The investor can invest any amount of his choice without limiting the minimum investment)

- Credit Rating System (Investors can track performances and track record developer)

- Liquid Investments (Our Exchange platform offers the flexibility for investors to liquidate their assets for any investment)

- Zero Investment Duty (the basis of the holder of the token will be able to use the platform without any commissions when dividends are received on the Joint Stock Fund)

- Dividends and target profitability (The volume of investments in commercial real estate offers high profitability and dividends of the database for any class of assets around the world)

- 3KB / 2017

- Formation of the Company

- the formation of equitybase

- Team building. The first steps in the development of the architecture of the platform are equitybase. - 4kV / 2017

- Financing

- Development

- Starting Capital: $ 300,000

- Start developing the platform - 1Q / 2018

- Crowdsale

- Individual Pre-sale

- Preliminary IKO

- Public IKO

- Demo version of the platform will be released

- Front-End and Back-End development, API testing - 2KB / 2018

- Dividends

- Platform Release

Platform - Beta version of Equity Invest

- Exchange of the list of basic markers

- Aggregation of liquidity from several stock exchanges - 3KB / 2018

- Development

- Acquisition of users

- Launching the Mobile Application

- Partnerships and user engagement

- Credit rating and detailed reporting, integration - 4kV / 2018

- Extension

- Create a regional office in London, Shanghai

- Expansion of proposals for hedge funds and private investment funds

- Equity fund of IKO

- Converting direct FIATA money

- Marker symbol: BASE

- Common delivery marker: 360,000,000 BASE

- Rigid Restriction: $ 50.4 Million.

- Marker Price: $ 0.28

- Minimal purchase: No

- Reception: Ethereum, Bank Transfer

- ERC20 marker: yes

- Individual Cover: None

- Countries are allowed: Equitybase does not exclude people from any countries from participating in our IRS. We, residents, citizens, and Green Card holders need to confirm their rights as accredited investors. All participants are invited to visit the relevant country / region to regulate the IKO. As an alternative to the provision of financial documents, US investors can be accredited if they can provide evidence that they have at least $ 1mm of crypto currency at the enterprise.

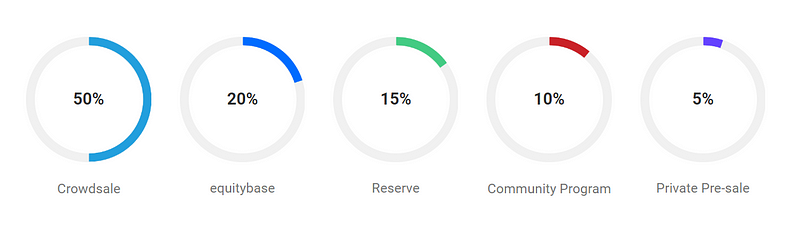

- 180mm (50%) bases should be allocated to the base of the sale of the marker.

- 72 mm (20%) of the grounds for entering into a wallet with a multi-signature and spent Equitybase for long-term investments and network updates.

- 48MM (15%) base will be used for backup

- 36MM (10%) of the grounds should be allocated to bounties and community-based, including consultants, home partners on the equitybase platform.

- 18mm (5%) from the base offer for private pre-sale

Morgan M. Chan

Founder / CEO

General partner Sapphire capital of commercial real estate development company with $ 100 million under management. He started to work and several IT and consumer electronics since 2000.

Founder / CEO

General partner Sapphire capital of commercial real estate development company with $ 100 million under management. He started to work and several IT and consumer electronics since 2000.

Connie Yiu

Co-founder / Marketing Director

Earlier in the dollar shaving club as a manager of social networks, regulates all aspects of social marketing. DSC acquisition by Unilever in 2016 for $ 1 billion. Before DSC, she was at newegg, as a marketing manager.

Co-founder / Marketing Director

Earlier in the dollar shaving club as a manager of social networks, regulates all aspects of social marketing. DSC acquisition by Unilever in 2016 for $ 1 billion. Before DSC, she was at newegg, as a marketing manager.

Lee Lois

Chief Legal Adviser

Chief Legal Adviser

Fares A. Cordovez

Developer of "Smart" Contracts

Developer of "Smart" Contracts

Trustin Cheung

Community Manager

Community Manager

Booyon Choi

Legal Advisor

The principle in the capital is the law of Tsoi

Legal Advisor

The principle in the capital is the law of Tsoi

Eduard Gubarik

Commercial Financing Advisor

General partner of the developer loans

Commercial Financing Advisor

General partner of the developer loans

Christian Rokitta

Advisor Finteh

Founder insoro

Advisor Finteh

Founder insoro

Vincent Petrescu

Advisor to CrowdFanding

Trucrowd CEO

Advisor to CrowdFanding

Trucrowd CEO

MORE INFO

WebsiteWhitepaper

Teleram

Komentar

Posting Komentar