DeHedge - Risk-hedging platform for cryptocurrency investors

About DeHedge

DeHedge platform - perspective investment in ICO with investment protection

The DeHedge platform is a fundamentally new format with a developed infrastructure and a complex of powerful tools for the protection of crypto-investments.

The main task is to prepare a stable and convenient decentralized platform for hedging investors' risks in crypto-currencies. The goal of the developers is to carefully consider the reliable protection of investments in the ICO and the security of crypto currency against the risk of fraud, failure of selected projects or serious fluctuations in rates.

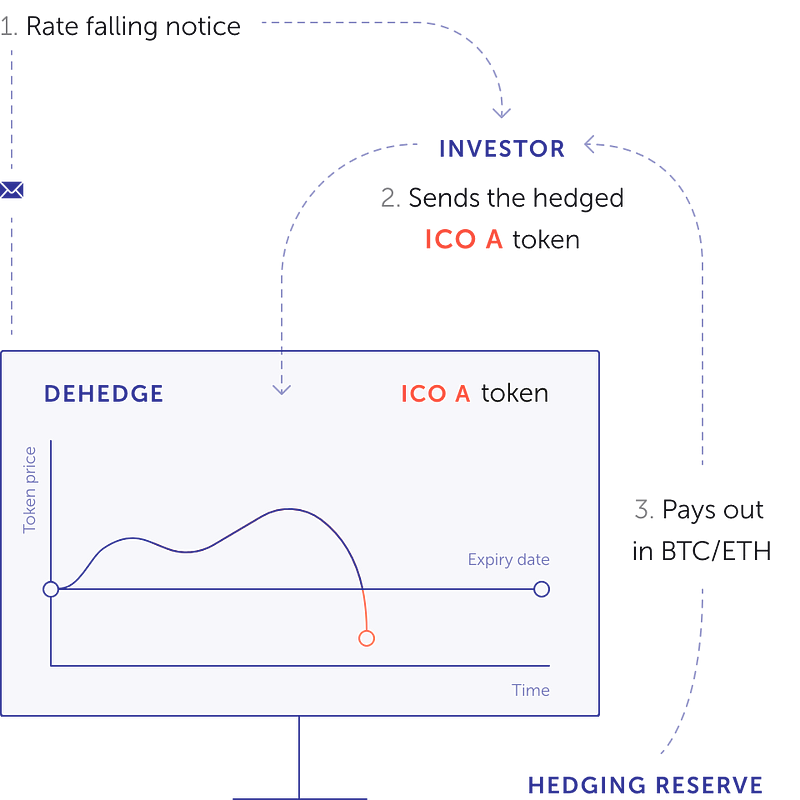

Automatic payment of compensation

The work of the DeHedge platform is based on the use of the advanced technology of smart contracts Ethereum with the guarantee of automatic and full reimbursement in the event of a fall in the price of the hedged token. If desired, the investor himself can refuse to receive an automatic payment, independently deciding on a request for compensation.

Coverage does not exceed reserves

Any transaction is reserved by a smart contract with the formation of security until the full recovery of losses incurred by the investor, according to the hedging option chosen by it. The investor gets convenient opportunities to accurately control the amount of reserved compensation through the block.

What gives DeHedge to investors - the progressive capabilities of the new platform

- Protection of investors' investments in ICO projects.

- Protection from excessive volatility of courses in the activity of crypto-currency traders.

- Preservation of profitability and attraction of investors for heads of investment funds.

- Attraction of investors in ICO-projects.

- Attracting additional investments for ICO sites.

- Protection against exchange rate fluctuations for buyers of mining farms.

At the heart of the DeHedge platform, the progressive scoring model for accurate and objective evaluation of ICO projects is the author's development based on the analysis of big data with the guarantee of investor protection in case of falling token rates or liquidation of the project.

How will the collected funds of ICO platform DeHedge

- 80% of the funds under the project will be directed to the formation of a reserve fund.

- 12% of the funds received - for the development and development of the project, the content of a qualified team.

- 6% of funds - are directed to the tasks of marketing and general promotion of the platform.

- 2% of funds - for a complex of necessary accounting and legal services.

- 80% of tokens are allocated to the ICO.

- 15% of the tokens are provided to the project team.

- 2% are for the bounty program.

- 2% are allocated for advisers.

- 1% - for marketing tasks.

Forecast growth of the DHT token exchange rate

The growth rate of DeHedge tokens is affected by four indicators

- Reduction in the number of tokens in free circulation;

- Increase in the hedge reserve;

- Increased demand for hedging;

- Increasing the product line by hedge

Planned DeHedge products

- Hedging transactions on exchanges.

- Hedging of wallets.

- Hedging the risks of currency fluctuations for buyers of mining farms.

- Hedging of lost profit for miners.

- Hedging of mining equipment. Entering new products on the DeHedge platform will increase the demand for DHT tokens, which in turn will increase the cost of the token

Ecosystem

The DeHedge project will be implemented on the public blockbuster Ethereum. The Ethereum blockbuster is the industry standard for issuing digital assets and smart contracts. The ERC20 token interface allows you to deploy a standard token that is compatible with the existing infrastructure of the Ethereum ecosystem, including development tools, wallets and exchangers. The Ethereum block is excellent for the needs of the DeHedge project: release of tokens, decentralized fixation of hedging obligations, payment and payment methods. DHT follows the ERC20 standard. Smart contracts will be implemented in the Solidity programming language.

Roadmap

- Q2 / 2017

Formation of the Investment Research team and the Data Science department

Start of the development of a scoring model - Q3 / 2017

Testing the scoring model - Q4 / 2017

Development of a platform for hedging risks of investors in ICO projects

Start of work of the investment committee (formation of a collegial expert investment committee) - Q1 / 2018

Launch of the Beta version of the platform

Test hedging ICOs

Launch of the investor's Personal Account within the framework of the DeHedge ICO

Completion of registration procedures in accordance with US law (Regulation D) for the sale of tokens in the United States to American qualified investors

Development of a platform for hedging tokens on the secondary market

Private / Public Pre-Sale

Establishment of partnerships with underwriting pools and liquidity providers

Road Show - Q2 / 2018

Testing the platform for token hedging on the secondary market

Calibration of the existing scoring model

Road Show

ICO Main Sale

Obtaining the license for an operational company for the core business — financial services

Launch of the hedging platform for tokens on the secondary market

Formation of the secondary market risk management system

Testing options desks on a real portfolio of market risk with the development of a strategy for dynamic DH risk hedging

Building front-to-back business processes

Launch of test analytical coverage of significant ICOs and events affecting the dynamics and cost of crypto assets (available to a limited number of subscribers)

Building cross-cutting, front-to-back business processes to integrate investment research and scoring into the DH risk management system

Formation of partnerships with mining pools

Launch of underwriting and consulting services - Q3 / 2018

Launch of the DeHedge research portal

Launch of a product to hedge the risks of mining farmsbuyers from exchange rate fluctuations

Completion of automation of front-to-back business processes

Publication in the investor's Personal Account of the first pool of tools available for hedging with DHTs

Launch of the platform Telegram chat-bot - Q4 / 2018

Launch of hedging on alternative blockchains

Start of development of AI for project scoring

Launch of a mobile platform application

Registration of additional legal entities in the DeHedge group of companies for operations scaling purposes

Publication of periodic materials of investment research for a wide range of investors - Q1 / 2019

Start of development of a derivatives trading website (based on the decision of the investment committee in case of a shortage of instruments and toolkits on the main platform necessary to meet the needs of platform users)

AI scoring testing - Q2 / 2019

Launch of AI scoring

Development of a Beta version of the derivative platform with full functionality for hedging positions

Q3 / 2019

Launch of a derivative platform with full functionality for hedging positions

Mikhail Chernov

Founder & CEO

Successful IT entrepreneur, founder of multiple startups, experienced investor in equity and cryptomarkets.

Founder & CEO

Successful IT entrepreneur, founder of multiple startups, experienced investor in equity and cryptomarkets.

Bogdan Leonov

Co-Founder & CCO

Experienced banking professional responsible for relationship management with top-tier clients in a number of local commercial banks.

Co-Founder & CCO

Experienced banking professional responsible for relationship management with top-tier clients in a number of local commercial banks.

Dmitry Ansimov

Co-Founder & COO

Ph.D, investment banking professional and a partner of Russian top investment bank Troika Dialog (acquired by Sberbank) with 12+ years track record in Global Markets & IB.

Co-Founder & COO

Ph.D, investment banking professional and a partner of Russian top investment bank Troika Dialog (acquired by Sberbank) with 12+ years track record in Global Markets & IB.

Komentar

Posting Komentar